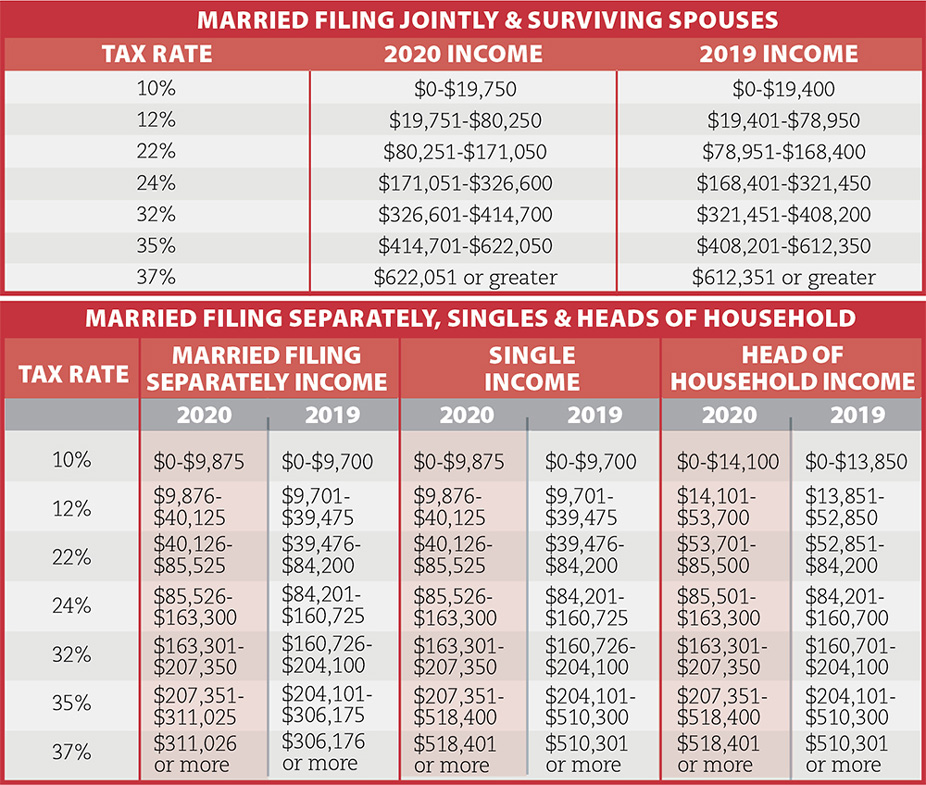

Big Income, Big Taxes

The IRS issued a final ruling explaining how to qualify for a real estate income safe harbor to receive the Qualified Business Income (QBI) deduction. You will need to make this safe harbor determination annually. PAY NOW The alternative minimum tax (AMT), will see its exemption amount rise in 2020 to $72,900 and begin to … Read more